They're suburbs that aren't talked about much, but Smithfield Plains, Elizabeth North and Munno Para in Adelaide's north are the most lucrative when it comes to rental returns.

Property Investment Coaching data shows that, of Adelaide's top 30 suburbs for average gross rental yields, the vast majority (26) are suburbs located north of the city. The remaining suburbs are either located in the far south (Hackham West, Noarlunga Downs and Aldinga) or north east (Surrey Downs).

Looking at the top 5 suburbs in the table below, it becomes obvious that most are well below the Adelaide median price. Smithfield Plains and Elizabeth North offer the best value with median prices just above $250,000 and average gross rental yields of almost 6%.

Suburb | Region | Median Sale Price ($) | Median Weekly Rent ($) | Rental Yield |

|---|---|---|---|---|

Smithfield Plains | North | 265,000 | 300 | 5.89% |

Elizabeth North | North | 257,000 | 290 | 5.87% |

Munno Para | North | 326,000 | 360 | 5.74% |

Evanston Gardens | North | 353,750 | 390 | 5.73% |

Munno Parra West | North | 350,000 | 370 | 5.50% |

Below we divide the top rental yield suburbs by region to pick up on any patterns and understand the drivers behind higher yields.

Adelaide's highest rental yields can be found in the Northern Suburbs

Looking at the northern suburbs, those that offer higher yields tend to be in a cluster of outer northern suburbs that are around 40-45 minutes outside the CBD and border Main North Road. They are developing areas with low median prices and a high proportion of renters. The state government has flagged significant investment in these areas over the next decade and we see great opportunities, particularly in the suburb of Andrews Farm.

Suburbs with high yields can also be found in the North East

Adelaide's north eastern suburbs have tended to offer higher capital growth relative to the neighbouring northern suburbs. As a result, average rental yields are lower but the suburb of Surrey Downs offers close to 4.5% yield to investors looking for positive cash flow.

The Southern Suburbs offer a combination of above average yields and capital growth

The southern suburbs offer an attractive combination of high yields and solid capital growth for investors. For example, Hackham West has an average gross yield of 4.6% and house prices in the suburb rose 44% between 2020 and 2021. Part of the demand for these suburbs by renters can be explained by their close proximity to the beach and short distance by car or public transport to Adelaide's CBD.

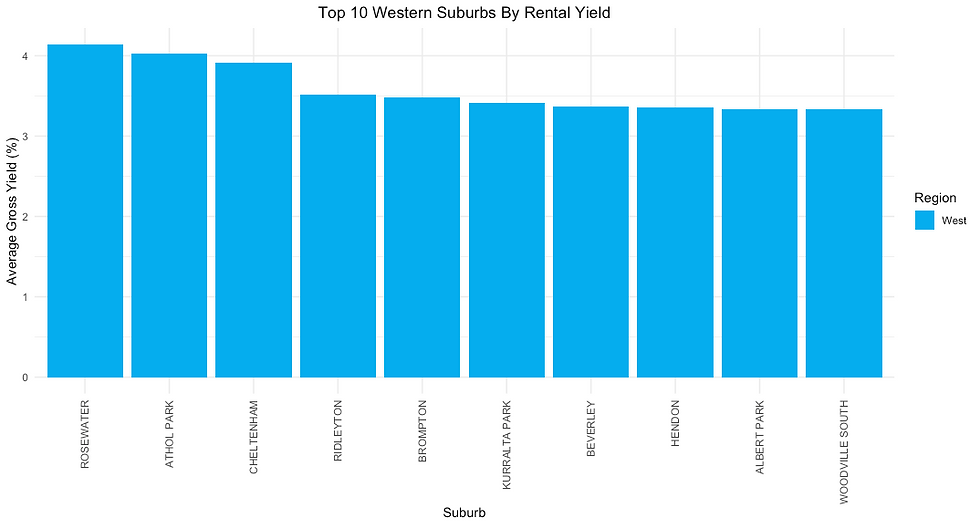

The Western Suburbs are in high demand but offer lower yields with some exceptions

The western suburbs have been in high demand in 2022 - from renters and owner occupiers. Rosewater and Athol Park are two suburbs in Adelaide's west that offer average gross rental yields above 4%, which combined with the strong capital growth seen over the past year, offer total returns in excess of 30% to eager investors. There is strong demand for homes in Adelaide's western suburbs partly due to short travel time to the CBD, amenities and popular beaches.

However the Eastern Suburbs offer the lowest yields and high capital growth

Historically, Adelaide's eastern suburbs have not offered the high rental yields seen in other parts of the city. These suburbs have fewer renters, higher median prices and offer lower gross rental yields. However, to compensate for these lower yields, house prices have risen strongly over the past decade in the eastern suburbs.

Contact us to learn more

For a full list of Adelaide suburbs with average rental yields or if you have any questions, use the contact form here: https://www.propertyinvestmentcoaching.com.au/

Alternatively, use the details below:

Phone: 1300 944 039

Comentários